What to Expect From Broadcom's Next Quarterly Earnings Report

/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)

With a market cap of $1.4 trillion, Broadcom Inc. (AVGO) is a leading global technology company that designs, develops, and supplies a wide range of semiconductor and infrastructure software solutions. Its products power diverse applications across enterprise networking, data centers, broadband, mobile communications, industrial automation, and cybersecurity.

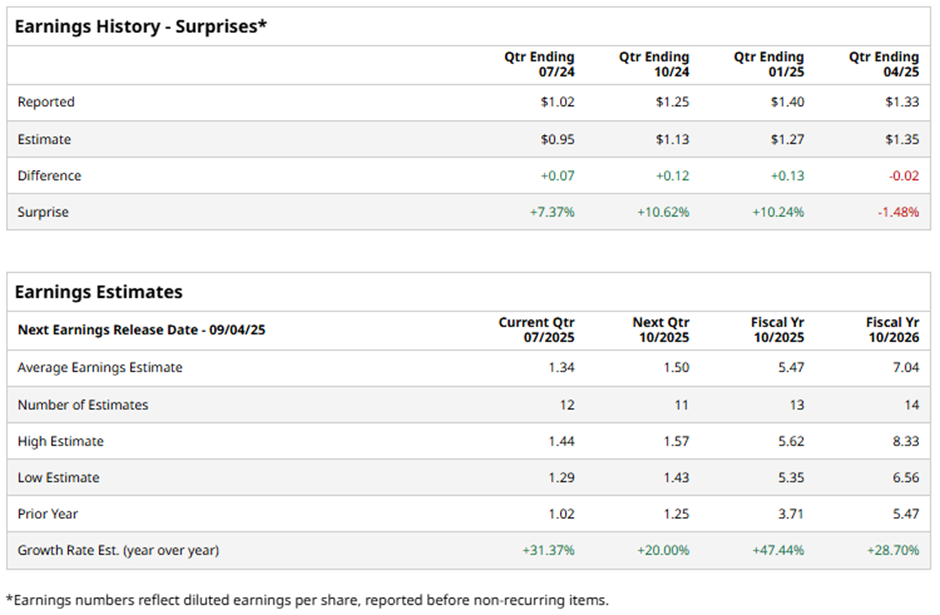

The Palo Alto, California-based company is slated to announce its fiscal Q3 2025 earnings results on Thursday, Sept. 4. Ahead of this event, analysts expect Broadcom to report an EPS of $1.34, a 31.4% growth from $1.02 in the year-ago quarter. It has exceeded Wall Street's earnings expectations in three of the past four quarters while missing on another occasion.

For fiscal 2025, analysts expect the chipmaker to report EPS of $5.47, marking an increase of 47.4% from $3.71 in fiscal 2024.

Shares of Broadcom have surged 92.3% over the past 52 weeks, outpacing the broader S&P 500 Index's ($SPX) 17.2% return and the Technology Select Sector SPDR Fund's (XLK) 21.9% rise over the same period.

Despite reporting better-than-expected Q2 2025 adjusted EPS of $1.58 and revenue of $15 billion on Jun. 5, Broadcom shares fell 5% the next day due to investor disappointment with its Q3 revenue forecast of around $15.8 billion, which only slightly exceeded analysts’ estimate. Investors had high expectations fueled by the AI boom and Broadcom's $1 trillion valuation, leading to a negative reaction when the guidance failed to signal a stronger acceleration. Additionally, concerns over the slow ramp-up of its custom AI processor business, with Morgan Stanley noting only "two additional customers" contributing modestly, added to the cautious sentiment.

Analysts' consensus view on Broadcom stock remains bullish, with a "Strong Buy" rating overall. Out of 36 analysts covering the stock, 32 recommend a "Strong Buy," one "Moderate Buy," and three "Holds." As of writing, the stock is trading below the average analyst price target of $298.55.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.